For many, the allure of a sleek, two-wheeled companion has always been a dream. Whether it’s the thrill of the open road, the environmental benefits, or the sheer joy of cycling, owning a bike can be an exciting prospect. But, in today’s world, where convenience often trumps tradition, you might be wondering: Can you buy a bike on a credit card?

In this article, we’ll explore the possibilities and considerations of purchasing a bicycle with a credit card. We’ll delve into the advantages, potential pitfalls, and financial aspects of making such a decision. So, fasten your helmet, and let’s pedal through the world of bike purchases with plastic money!

Related Article

1) The Pros of Buying a Bike with a Credit Card

a) Convenience and Flexibility

The utilization of a credit card for acquiring a bike brings forth a host of advantages, the foremost being the convenience and flexibility it affords. When you opt for a credit card, the concerns associated with carrying substantial amounts of cash or navigating the intricacies of a personal loan are alleviated. Instead, a simple card swipe can whisk you away on your new bike adventure. Moreover, most credit cards extend a grace period, granting you the liberty to make your purchase and subsequently settle the amount in manageable installments, all without incurring any interest charges if you complete the payments within the billing cycle. This convenient and adaptable approach ensures that your bike ownership experience is both hassle-free and tailored to your financial preferences.

b) Safety and Security

When you choose to utilize a credit card as your payment method, you’re embracing an additional layer of safety and security that might not be as readily available with other payment options. In the unfortunate event of theft or damage to your recently acquired bike, many credit cards come to your rescue with their valuable purchase protection and extended warranty coverage. This aspect can prove to be a crucial advantage, particularly when you’re making an investment in a high-quality bicycle. Your financial decision is reinforced with the peace of mind that your bike ownership is safeguarded, making your riding experience both enjoyable and worry-free.

c) Rewards and Cashback

A noteworthy advantage of credit card usage is the opportunity to earn rewards, cashback, or miles for every dollar expended. Opting to purchase a bike with your credit card may open the door to the potential accumulation of valuable rewards. These rewards can later be redeemed for a variety of purposes, including accessories, maintenance, or even fueling your next thrilling cycling escapade. This added benefit enhances your financial decision, turning your bike purchase into an opportunity to reap more value from your spending, and further enriching your cycling experience.

2) The Cons of Buying a Bike with a Credit Card

a) Interest Charges

Though credit cards offer convenience, they come with the potential for substantial interest charges should you fail to pay off the balance in full by the due date. The relatively high-interest rates associated with credit cards can notably inflate the overall cost of your bike purchase, especially if you end up carrying a balance over an extended period. It’s paramount to be well-informed about your card’s interest rate and to assess your capacity for meeting payment deadlines promptly. Your financial acumen in managing these aspects plays a pivotal role in ensuring that using a credit card to acquire a bike aligns with your long-term financial well-being.

b) Impact on Credit Score

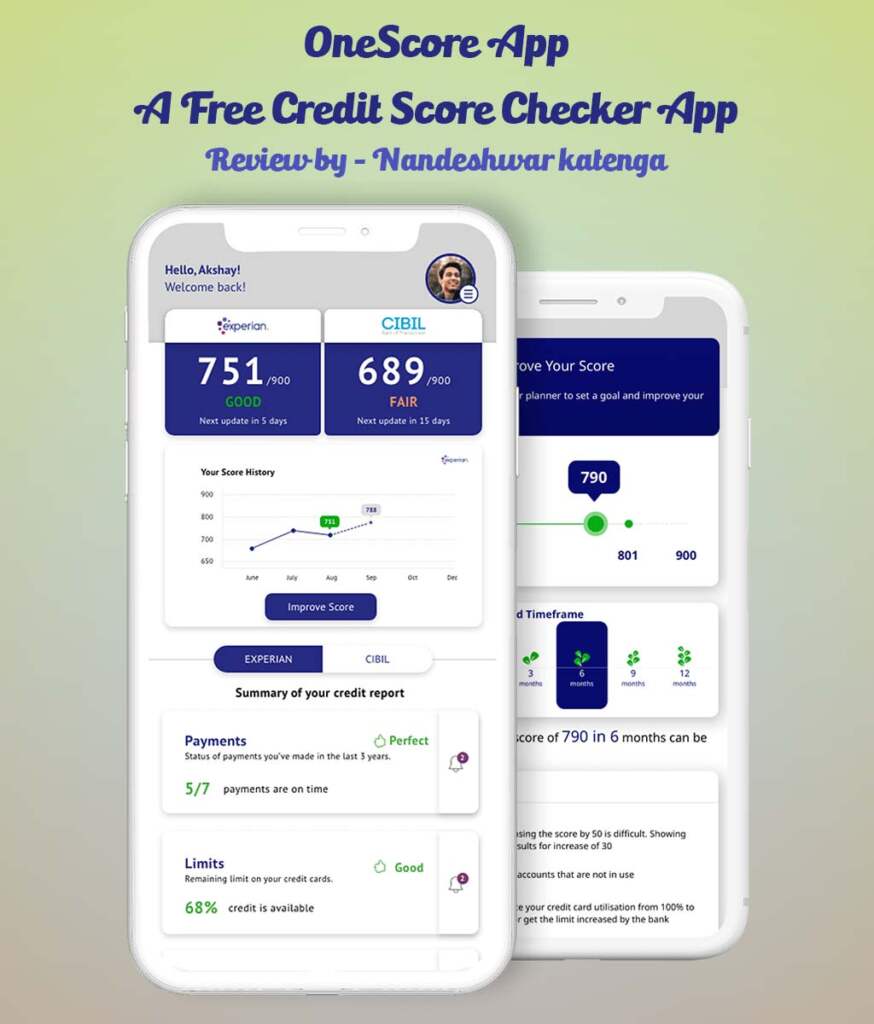

Credit card leaves an imprint on your credit score with each transaction. If you consistently max out your credit card or maintain high balances, it can exert an adverse influence on your credit score. A lower credit score can subsequently result in challenges when seeking future loans or credit, potentially impacting your financial flexibility and options down the road. Understanding the intricate relationship between your credit card usage and your credit score is a fundamental aspect of prudent financial management.

c) Impulse Spending

Tendency to entice individuals into making impromptu purchases, which can include buying a bike. In this scenario, it becomes paramount to engage in a thoughtful evaluation to ascertain whether the purchase of a bike is a genuine necessity, fits within your financial means, and isn’t merely the result of a spur-of-the-moment decision. Succumbing to impulsive spending can potentially usher in financial strain and debt, reinforcing the significance of making well-considered financial choices that align with your long-term goals and financial security.

3) Financial Considerations

a) Budgeting and Affordability

Prior to embarking on the journey of purchasing a bike with your credit card, it’s imperative to establish a comprehensive budget. This involves meticulously calculating the entire cost of the bike, which includes factoring in taxes, accessories, and any potential maintenance expenses. It is of utmost importance to confirm that this financial outlay aligns with your financial capacity and is comfortably manageable without necessitating reliance on credit for essential day-to-day living expenses. Engaging in such prudent financial planning ensures that your bike acquisition harmonizes with your broader financial well-being and aspirations.

b) Credit Card Terms

With a credit card, it is advisable to delve into the intricacies of your card’s terms and conditions. This entails a thorough review of factors such as the interest rate, credit limit, and the invaluable grace period. The grace period represents a specific timeframe within which you have the opportunity to settle your balance without incurring any interest charges. Ideally, your aim should be to complete the payment for your bike purchase within this grace period, a strategic move that allows you to steer clear of any interest-related costs, ultimately enhancing the financial prudence of your decision. Understanding and navigating these credit card terms is a pivotal element in optimizing the benefits and cost-efficiency of your bike acquisition.

c) Alternative Financing Options

In cases where the interest rates on your credit card appear to be on the higher side, it can be a judicious move to explore alternative financing avenues. Such alternatives may encompass the prospect of opting for a personal loan or capitalizing on a financing program offered by a bike shop. These financing choices frequently present the advantage of more favorable interest rates compared to credit cards, potentially leading to substantial savings over the long term. Hence, a comprehensive exploration of these alternative financial options can be a strategically sound decision, providing you with the opportunity to optimize the financial dynamics of your bike purchase.

d) Making Timely Payments

Order to steer clear of accumulating interest charges and safeguard your credit score, it is paramount to uphold a commitment to making punctual payments on your credit card balance. One strategic approach is to explore the setup of automatic payments or utilize reminder systems to provide the assurance that due dates are consistently met. By doing so, you proactively manage your financial responsibilities, cultivating a sound credit history while avoiding the financial pitfalls associated with delayed or missed payments.

FAQs – Frequently Asked Question

Q. Can I buy a bike on a credit card?

Ans. Yes, you can purchase a bike using a credit card for added convenience.

Q. What are the advantages of buying a bike with a credit card?

Ans. Credit cards offer convenience, security, and the potential to earn rewards or cashback.

Q. Are there any downsides to using a credit card to buy a bike?

Ans. Yes, high-interest charges and the potential impact on your credit score are drawbacks to consider.

Q. What should I check in my credit card terms before buying a bike?

Ans. Review your credit card’s interest rate, credit limit, and grace period for interest-free payments.

Q. Can buying a bike on credit affect my credit score?

Ans. Yes, carrying a high balance on your credit card can negatively impact your credit score.

Q. How can I avoid paying interest when buying a bike with a credit card?

Ans. Pay off the balance within the credit card’s grace period to avoid interest charges.

Q. Are there alternative financing options for purchasing a bike?

Ans. Yes, you can explore personal loans or financing programs offered by bike shops, which may have lower interest rates.

Q. Is it advisable to make impulse bike purchases with a credit card?

Ans. It’s not recommended, as impulse spending can lead to financial stress and debt.

Q. What are some tips for responsible credit card use when buying a bike?

Ans. Set up automatic payments, keep track of due dates, and only use your credit card for purchases you can afford.

Q. Is buying a bike with a credit card a good choice for my finances?

Ans. It can be a suitable option if you have a clear budget, can make timely payments, and understand the terms of your credit card. Evaluate your financial situation carefully before proceeding.

Conclusion

In the world of modern finance, buying a bike on a credit card is indeed possible and offers a range of conveniences. However, it’s essential to tread carefully and make informed decisions. The advantages of convenience, security, and potential rewards must be weighed against the disadvantages of interest charges, potential credit score impact, and impulse spending.

Before taking the plunge, evaluate your financial situation, budget, and the terms of your credit card. If the numbers add up and you can make responsible financial decisions, buying a bike with a credit card can be a rewarding experience that propels you on your two-wheeled adventures. So, grab your helmet, choose your ride, and hit the open road – responsibly!